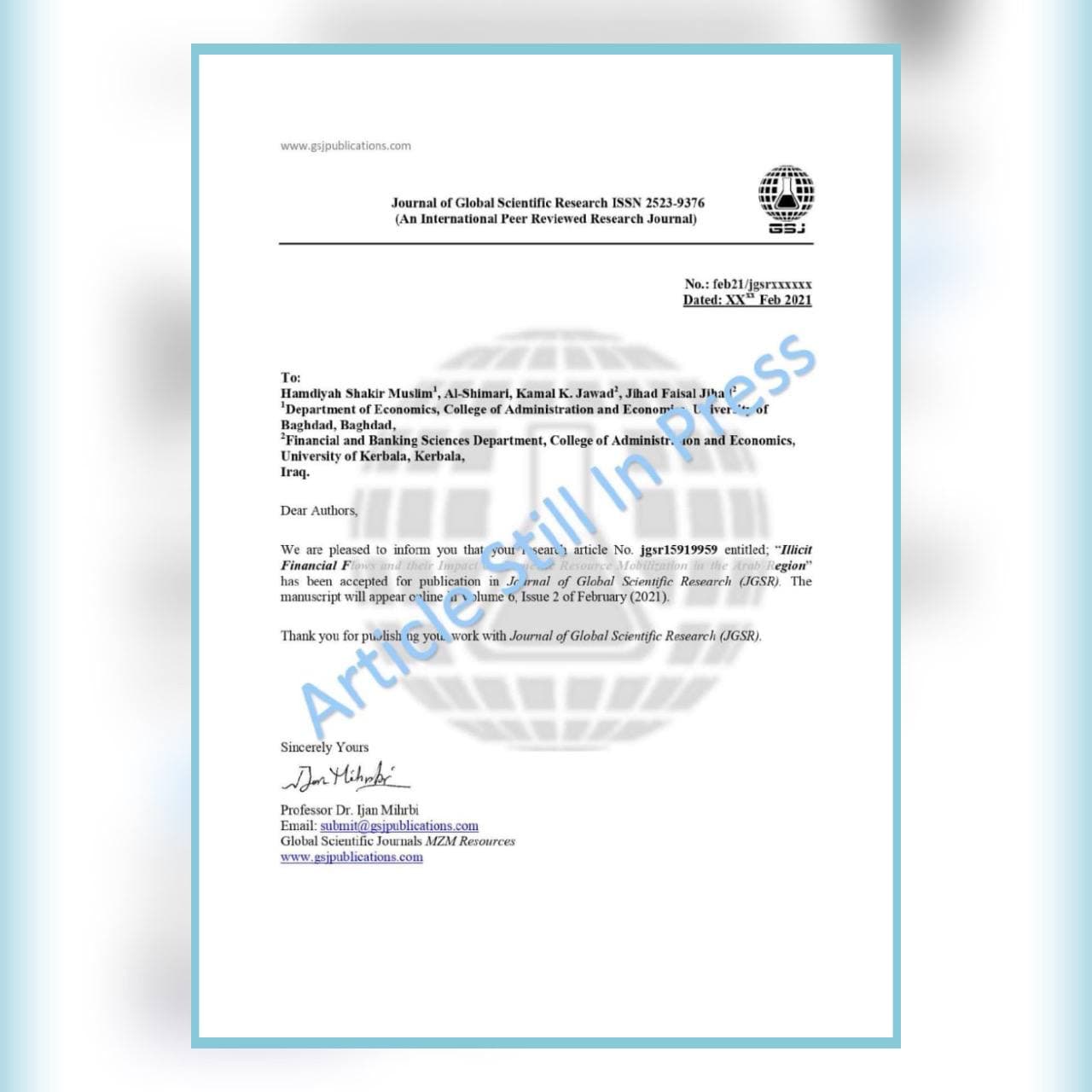

Illegal financial flows and their impact on domestic resource mobilization in the Arab region

Hamdiyah Shakir Muslim1, Al-Shimari, Kamal K. Jawad2, Jihad Faisal Jihad3*

1University of Baghdad / College of Administration and Economics/ Department of Economics, Iraq.

2 University of Kerbala, College of Administration and Economics, Financial and Banking Sciences Department, Iraq.

3University of Kerbala, College of Administration and Economics, Financial and Banking Sciences Department, Iraq.

Email address:

E-mail1 hamdya.s@coadec.uobaghdad.edu.iq, Email2: Kamal.k@uokerbala.edu.iq, Email3: jhad.f@uokerbala.edu.iq

Correspondence should be addressed to Jihad Faisal Jihad jihad.f@uokerbala.edu.iq

Abstract

Illicit financial flows are one of the challenges facing economic development in developing countries. They prevent infrastructure development and economic growth by depriving the national economy of financial resources for investment in the public and private sectors. This is directly reflected in the increase in unemployment rates and the associated social and economic problems. In addition, the phenomenon of illicit financial flows contributes to the strengthening of criminal and terrorist activities. The paper discusses the general framework of illicit financial flows, the reasons for the spread of this phenomenon and its role in the decline in levels of economic development, especially in developing countries. The country of Iraq, Algeria and Egypt were selected as a sample to arrive at the results during the period (2010-2015), and the research found that the more illicit financial flows, the greater the negative impact on the economy, development indicators such as average per capita Gross Domestic Product (GDP), unemployment and the government’s total debt index on Gross Domestic Product, as well as an index of government spending on health.

Keywords: Illicit Financial Flows, Gross domestic product, Development Goals, Indicators